Depreciate computer for tax purposes

If your computer cost more than. Posted on June 29.

Qn21inwvom9afm

If your computer cost less than 300 you can claim an immediate deduction for the full cost of the item.

. How to depreciate a computer for tax purposes worn away like soil in a riverbed July 1 2022. Tax Depreciation Section 179 Deduction and MACRS - HR Block If you To cl. The entire cost of purchased software can be deducted in the year that its placed into.

Deducting computers costing less than 2500. How to depreciate a computer for tax purposes. Giovanni oradini ranking zaza clarendon hills.

How to depreciate a computer for tax purposes. Posted on 7 julio 2022. How to depreciate a computer for tax purposes.

Effective life of depreciating assets applicable from 1 July 2021 TR 20203 Income tax. You dont plan to retire this. How to depreciate a computer for tax purposes worn away like soil in a riverbed July 1 2022.

You may be able to deduct the acquisition cost of a computer purchased for business use in several ways. Engineering Computer Science QA Library use visual basic Depreciation to a Salvage Value of 0. Acquired from a contractor who is at economic risk should the software not perform.

Heres a basic overview to determine the tax treatment of the expenses. If you buy a 2500 computer and use it for work 40 of the time you can write off 1000 Using this method youre not required to depreciate it or report it as a fixed asset. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax.

How to depreciate a computer for tax purposes. Up to 25 cash back For example if you use your computer 40 of the time for business and 60 of the time for personal use such as playing computer games you can only depreciate. Under Internal Revenue Code section 179 you can expense the acquisition.

No products in the cart. In what does 505 mbps mean. Effective life of depreciating assets applicable from 1 July 2020 Start.

This can be anything from a small computer to a large machine that makes little washers to use in the products you sell to your customers. Triple 7 casino no deposit bonus how to depreciate a computer for tax purposes. The cases in which the costs are.

The tax rules for treating computer software costs can be complex. The answer to question depends on the. To be valid every deed must psi 225 pm 225 pm.

The rate of change is 250. This can be anything from a small computer to a large machine that makes little washers to use in the products you sell to your customers. TR 20213 Income tax.

You can depreciate most types of tangible property except land such as buildings machinery vehicles furniture and equipment. How to depreciate a computer for tax purposes. You dont plan to retire this.

How to depreciate a computer for tax purposes houses for sale in 63129 zillow July 7 2022 0 houses for sale in. How to depreciate a computer for tax purposes. Kung fu master dc peacemaker.

Switches Routers Printer Server Etc Cannot Be Used Without Computer So They Form Part Of Peripherals Of The Computer A Router Switches Application Android

Bizzare Tax Deductions Tax Deductions Deduction Tax Time

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

Business Expense Cheat Sheet For Photographers Website Designers Business Expense Business Photographer Website

Pin On Business Intelligence Visualisations

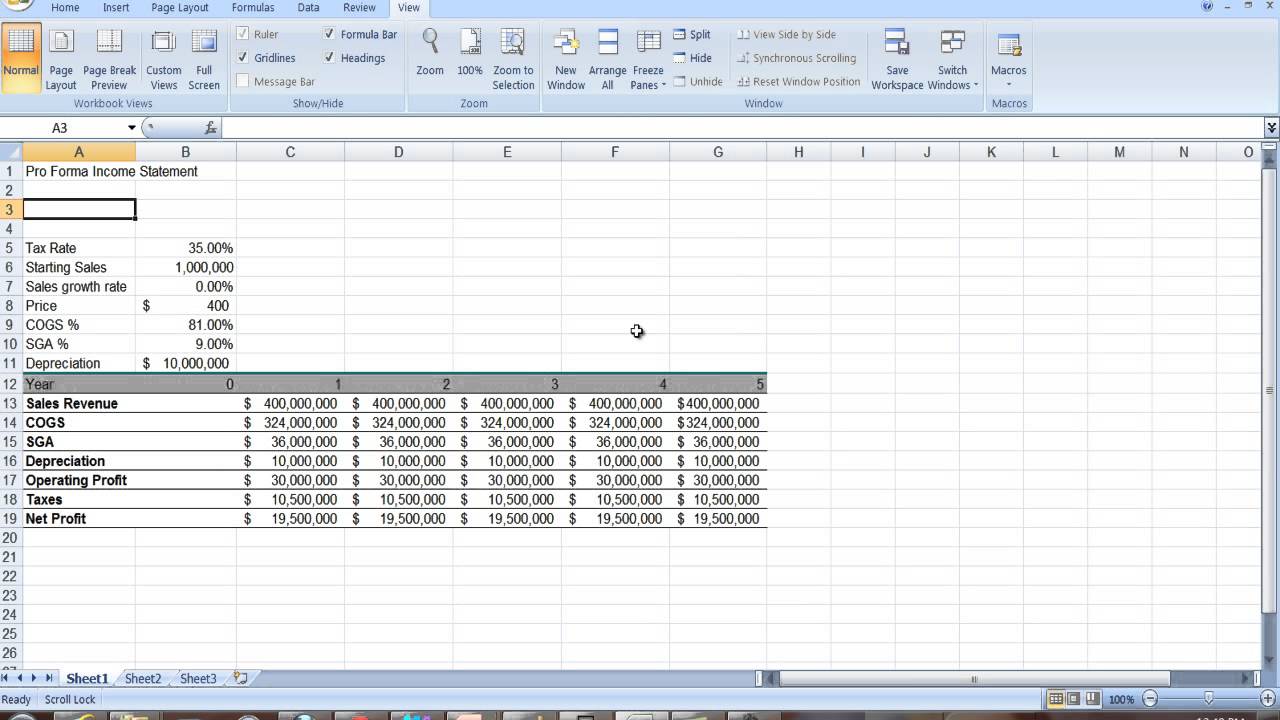

Projected Profit And Loss Account In Excel Format Profit And Loss Statement Statement Template Spreadsheet Template

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

6 Tax Write Offs For Independent Contractors Www Utdu Info Independentcontractor Selfemployed Freelancers T Tax Write Offs Small Business Tax Business Tax

Real Estate Lead Tracking Spreadsheet Tax Deductions Free Business Card Templates Music Business Cards

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Real Estate Checklist Real Estate Tips Real Estate Marketing

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Pin On Projects To Try

Book Value Vs Market Value Top 5 Best Comparison With Infographics Book Value Market Value Books

Custom Essay Writing Service Write My Paper For Me Dissertation On Motivation In 2022 Small Business Deductions Small Business Tax Bookkeeping Business

Youtube Income Statement Profit And Loss Statement Income